Bush is going to lie and tell more lies right to the end. Does anyone really believe this:

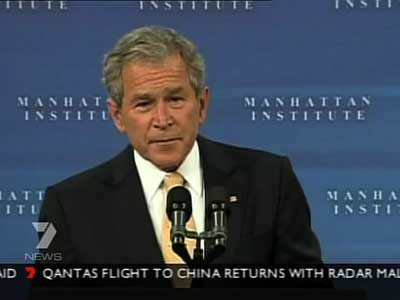

Bush, in a spirited defense of the free-enterprise system, pushed back against the idea that more government regulation was the answer to current woes.

"It would be a terrible mistake to allow a few months of crisis to undermine 60 years of success," he said in New York.

http://news.yahoo.com/s/nm/20081113/bs_nm/us_financial_summitWASHINGTON (Reuters) – A bid by global leaders to push forward plans this weekend to erect a firewall against future financial crises like the one now threatening the world economy will quickly run into tough political realities that will limit progress.

Leaders from the Group of 20 advanced and emerging economies are being hosted on Friday night and on Saturday by a U.S. president who will be out of office in little more than two months and who is under pressure from Europe to agree to stricter market regulation than he prefers.

Such key questions of global finance were once largely the domain of the rich Group of Seven nations, but the doors this time are thrown open more widely in recognition of the growing clout of other nations.

However, bringing emerging-market members into the gathering carries its own tension as wealthy nations seek a new role for institutions like the International Monetary Fund, which is viewed with reservation by many developing nations.

But as the world sinks into a recessionary funk, political chiefs are under strain to show they at least know why fortunes turned so severely and what must be done to ease the worst financial crisis since the 1930s Great Depression.

U.S. President George W. Bush on Thursday sought to keep a focus on measures for spurring growth rather than scrutiny of inadequacies in U.S. regulation, which European officials see as a root cause of crisis.

"While reforms in the financial sector are essential, the long-term solution to today's problems is sustained economic growth," Bush told a New York audience. He said critics were "equating the free enterprise system with greed, exploitation and failure" and objected to it.

"The answer is not to try to reinvent that system," Bush said. "It is to fix the problems we face, make the reforms we need, and move forward with the free-market principles that have delivered prosperity and hope to people around the world."

AIRING DIFFERENCES

Improving regulation is a broad topic for G20 leaders but there are long-standing differences, especially between European officials and the Bush administration, about the degree to which markets should be subject to stiffer rules.

German officials said before the meeting that it will discuss "a new balance between market and state," possibly a more ambitious aim than the Bush administration favors.

At a briefing on Wednesday, the White House's deputy national security adviser for international economic affairs, Dan Price, said market turmoil shows the need for "some changes in today's regulatory structures" but within limits.

"We are unaware of any support from any quarter for empowering a single global authority to regulate the world's financial markets," Price said, without referencing where he had heard such a suggestion made.

French President Nicolas Sarkozy sounded an aggressive note on Thursday as he prepared to head for the summit.

"I am leaving for Washington to explain that the dollar, which after the Second World War was the only currency in the world, can no longer claim to be the only currency in the world," he said. "What was true in 1945 cannot be true today."

Bush, in a spirited defense of the free-enterprise system, pushed back against the idea that more government regulation was the answer to current woes.

"It would be a terrible mistake to allow a few months of crisis to undermine 60 years of success," he said in New York.

GLOBAL POWER SHIFT

Among other issues for the participants is how to give key emerging market countries, especially China, which is now the world's fourth-largest economy, more say in global councils.

The so-called BRIC countries -- Brazil, Russia, India and China -- said at a meeting in Sao Paulo, Brazil, last weekend that they wanted more say in global policy-making to supplant the dominance of the Group of Seven industrial countries.

"The G7 can no longer be a little club on its own," said South Africa's finance minister, Trevor Manuel. Manuel was scheduled to attend the Washington summit as well.

This weekend's summit is intended as the first in a series, with another possible in next year's first quarter. It will produce a communique indicating some agreement on causes of the current crisis and possibly some specific actions for countries to apply within their national economies.

British Prime Minister Gordon Brown claimed on Wednesday there was growing support for increased fiscal measures globally to help weather the crisis and indicated he might press that theme at the summit.

Another area scheduled for discussion is how to step up the role of global institutions, especially the IMF, as monitors of financial system activity and lenders to nations when they get in trouble.

But countries from Asia to Latin American countries have some bitter memories of when the IMF imposed stiff conditions on receiving its help. It is unclear whether countries that have large shares, or quotas, in IMF governance will yield to let emerging-market countries take a bigger stake.

Canada's finance minister, Jim Flaherty, wrote in the Financial Times on Thursday that "dynamic new economic players ... must be full participants at the global table" and said Canada had given up some of its quota share.

Flaherty left unsaid that many regard European countries as holding a greater IMF quota share than they merit, and none has expressed a willingness to let their power wane.

No comments:

Post a Comment